Passive Investment Income and the Small Business Deduction Grind:

The federal government put forward a consultation paper in July 2017, that it was looking to prevent companies deferring excess income in the corporation to use it to earn passive investment income after paying small business tax rates.

Canadian-controlled private corporations (CCPCs) pay corporate income taxes on small business income at 9% federally (2019 onwards). The small business limit (the amount of income annually eligible for the small business rate) is $500,000 federally and in most provinces. Above $500,000 the general Federal tax rate is 15%. For Ontario, the small business limit is $500,000. Up to $500,000 the Ontario tax rate is 3.5% and above $500,000 it is 11.5%.

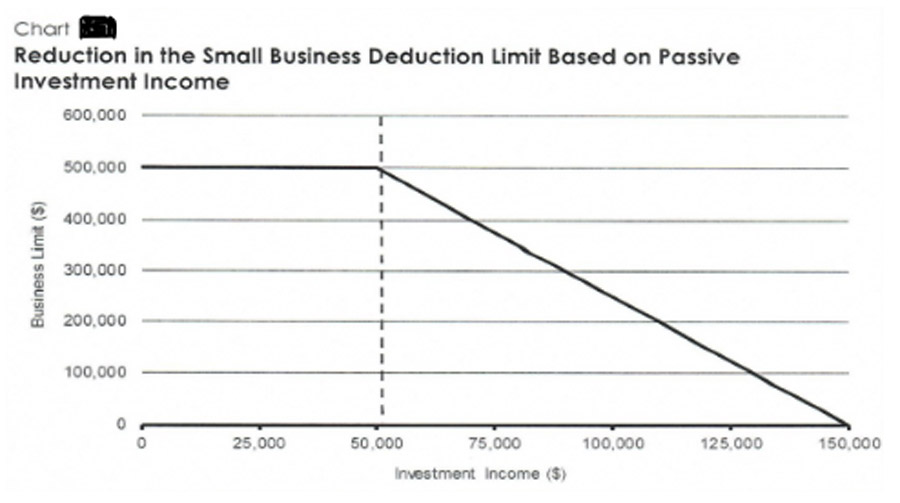

From tax years commencing from Jan 1, 2019, the business limit will be reduced by $5 for every $1 of investment income above $50,000 (the term used is “Adjusted Aggregate Investment Income”). If investment income reaches $150,000 in a given tax year, the small business rate will be eliminated.

| Passive Income Earned | Small Business Limit Reduction | Small Business Limit Available |

|---|---|---|

| $50,000 | $0 | $500,000 |

| $90,000 | 5 x ($90,000 – $50,000) = $200,000 | $300,000 |

| $150,000 | 5 x ($150,000 – $50,000) = $500,000 | Nil |

Most provinces have enacted legislation to mirror the federal changes, Ontario & New Brunswick have not and so the claw back will not apply on the Ontario & New Brunswick tax rates.

Investment income in associated companies must be aggregated to determine if the $50,000 threshold has been surpassed, and if so, determine the amount of the small business limit that will be clawed back.

The following types of situations are not affected as much due to the legislation changes:

- Where profits are routinely paid to individual Canadian resident shareholders, the additional cost is mainly a loss of deferral of tax.

Larger CCPCs. The small business limit begins to be phased out for associated CCPCs with greater than $10Mn in aggregate taxable capital employed in Canada and is eliminated when taxable capital reaches $15Mn.

Adjusted Aggregate Investment Income:

| Aggregate Investment Income (AII) | = net income from property (rent, interest, royalties) |

| + taxable capital gains for the year | |

| + taxable dividends | |

| + foreign investment income | |

| – taxable dividends | |

| – capital losses for the year | |

| – capital losses from prior years applied in the year | |

| Adjusted AII | = Aggregate Investment Income |

| + taxable dividends not received from a connected corporation | |

| + income arising from the disposition of an exempt policy | |

| + capital losses from prior years applied in the year | |

| – capital gains from the sale of active assets |

Tax planning aspects to minimize claw back:

- Develop a bias towards capital gains as opposed to interest & dividends – only half the capital gains are included in AII calculation.

- Timing of capital gains and capital losses.

- Have capital losses triggered in years where there are large capital gains.

- Realize capital gains in years where there is low business income or when investment income for the year is already over $150,000

- Purchasing active assets that could appreciate, such as investing in the building which the company would operate in.

- Keep the companies as qualifying small business corporations. Capital gains from sale of such shares are not part of the adjusted AII.

- Purchasing an exempt life insurance policy and putting passive investments into this, where allowed.

- Look into creating Individual Pension Plans

- Consider investments that also provide a return of capital regularly as part of their distributions. This would defer a portion of the tax until final disposal.

- Consider better allocation of expenses to reduce Net Investment Income

- Reasonable salary allocation for managing investment portion

- Investment counsel fees.

More Articles of Interest

Carbon Tax & Climate Action Incentive Payments in Ontario

What is Carbon Tax?

The Carbon Tax is one that greenhouse gas emitters must pay per tonne of carbon dioxide emitted from burning carbon-based fuels. To motivate emitters to change their practices to decrease emissions, the price goes up over time, so households and industries have time to adjust and adopt less carbon-heavy practices. This is set to be implemented from April 1,2019.

This has come about from Canada’s commitment under the Paris Agreement to work towards reducing global warming. In response, the federal government established Pan-American Framework on Clean Growth and Climate Change, which set carbon tax at a minimum of $20 per tonne in 2019, increasing by $10 per year until it hits $50 per tonne in 2022.

Keep Reading →Income Sprinkling Rules / Tax on Split Income (TOSI) – enacted Jun 2018

Legislation that contained the legalization of Cannabis obtained Royal Assent on Jun 21, 2018 (Bill C-74). Included in this Bill, were also the complicated rules covering Income Sprinkling, widely referred to as TOSI (Tax on Split Income) that were announced in December 2017.

The government’s objective is to eliminate the benefits of income splitting where the recipient of the income (a related family member) has not made a sufficient contribution to the family business. To accomplish this, they are subjecting income received under these rules to the highest marginal tax rates, thus eliminating any advantage achieved through income splitting. Since Jan 2000, there were such rules in place for those under the age of 18 (known as “Kiddie Tax”) – this has now been expanded to cover a broader age category.

Keep Reading →