Carbon Tax & Climate Action Incentive Payments in Ontario

What is Carbon Tax?

The Carbon Tax is one that greenhouse gas emitters must pay per tonne of carbon dioxide emitted from burning carbon-based fuels. To motivate emitters to change their practices to decrease emissions, the price goes up over time, so households and industries have time to adjust and adopt less carbon-heavy practices. This is set to be implemented from April 1,2019.

This has come about from Canada’s commitment under the Paris Agreement to work towards reducing global warming. In response, the federal government established Pan-American Framework on Clean Growth and Climate Change, which set carbon tax at a minimum of $20 per tonne in 2019, increasing by $10 per year until it hits $50 per tonne in 2022.

Where a province does not have its own carbon tax plan by 2019, the federal carbon tax is imposed. Ontario’s cap and trade program has been cancelled by the current ruling party.

How is a Consumer affected?

This is an indirect tax on consumers, meaning end consumers will not have to pay the tax directly, but they will face higher prices for goods and services from industries that emit higher greenhouse gases and pass these costs through the supply chain.

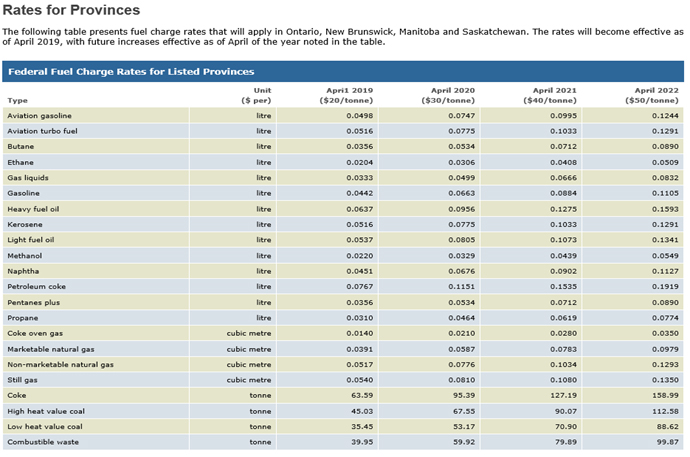

A more visible impact for consumers will be gas price increases. Gas prices are slated to go up by 4.4 cents per litre in April 2019, rising to 11 cents a litre by April 2022. The carbon tax charge by fuel type is shown in Exhibit 1 below.

Consumers will receive a government rebate called Climate Action Incentive Payments to offset some of the higher costs they would experience, starting with the filing of their 2018 tax returns.

How does the Climate Action Incentive Payment work?

For 2019, an Ontario family of four, will receive $307 under this proposal, calculated as follows:

- $154 for a single adult or the first adult in a couple

- $77 for the second adult in a couple. Single parents will receive this amount for their first child.

- $38 for each child in the family (starting with the second child for single parents).

This will be claimed as part of the 2018 tax return filing and will be received as of the tax return assessment.

There is an extra 10% supplement for residents of small and rural communities. Small and rural communities will be defined as anywhere outside of a census metropolitan area, as defined by Statistics Canada.

The payments in subsequent years (excluding the supplement for residents of small and rural communities) are expected to be as follows:

| 2020 | 2021 | 2022 | |

|---|---|---|---|

| First Adult | $226 | $295 | $360 |

| Spouse | $113 | $147 | $180 |

| Child | $56 | $73 | $89 |

| Family of four | $451 | $588 | $718 |

Exhibit 1

What about Quebec, Alberta and British Columbia’s Carbon Tax programs?

Quebec has a cap and trade system since 2013.

In Alberta, the carbon tax is presently $30 per tonne. This began in 2017.

British Columbia has had a carbon tax in place since 2008. Emissions in the province are now $40 per tonne, rising by $5 per tonne each year until the cost reaches $50 per tonne in 2021.

More Articles of Interest

Passive Investment Income and the Small Business Deduction Grind:

The federal government put forward a consultation paper in July 2017, that it was looking to prevent companies deferring excess income in the corporation to use it to earn passive investment income after paying small business tax rates.

Canadian-controlled private corporations (CCPCs) pay corporate income taxes on small business income at 9% federally (2019 onwards). The small business limit (the amount of income annually eligible for the small business rate) is $500,000 federally and in most provinces. Above $500,000 the general Federal tax rate is 15%. For Ontario, the small business limit is $500,000. Up to $500,000 the Ontario tax rate is 3.5% and above $500,000 it is 11.5%.

Keep Reading →Income Sprinkling Rules / Tax on Split Income (TOSI) – enacted Jun 2018

Legislation that contained the legalization of Cannabis obtained Royal Assent on Jun 21, 2018 (Bill C-74). Included in this Bill, were also the complicated rules covering Income Sprinkling, widely referred to as TOSI (Tax on Split Income) that were announced in December 2017.

The government’s objective is to eliminate the benefits of income splitting where the recipient of the income (a related family member) has not made a sufficient contribution to the family business. To accomplish this, they are subjecting income received under these rules to the highest marginal tax rates, thus eliminating any advantage achieved through income splitting. Since Jan 2000, there were such rules in place for those under the age of 18 (known as “Kiddie Tax”) – this has now been expanded to cover a broader age category.

Keep Reading →